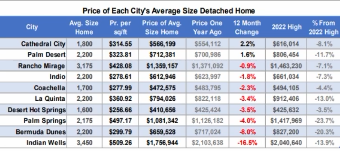

Why Is the Condo Market Struggling in 2025? It Comes Down to Affordability—and Simple Math. The Photo above is year to date condo market update in the Coachella Valley

The slowdown in the condo and townhome market isn’t due to a lack of buyers or a decline in interest for this type of housing. The demand is still there. The real issue is affordability and the math behind the cost of ownership.

Most condo buyers fall into the entry-level or first-time homebuyer category. This group is especially sensitive to monthly costs, upfront expenses, and long-term financial value. And today, the numbers simply aren’t penciling out the way they used to.

The Cost Comparison: Buying vs. Renting

Take, for example, a $350,000 condo in Palm Springs or the surrounding Coachella Valley, with a 20% down payment:

| Expense | Approx. Monthly Cost |

|---|---|

| Mortgage (Principal + Interest) | $1750. /month |

| HOA Dues + Taxes + Insurance | +$1000./month |

| Total Monthly Ownership Cost | $2,750/month |

Meanwhile, the same unit can often be rented for around $2,200/month — with no upfront down payment.

So, a buyer is left asking a very reasonable question:

“Why would I tie up my savings and pay more each month when I can rent the same home for less?”

The Impact on Sellers and Pricing Strategy

This is where pricing strategy becomes crucial.

Pricing solely based on price-per-square-foot is no longer effective.

Entry-level buyers today are careful, informed, and cost-conscious. They understand that:

- HOA fees often increase annually.

- Insurance premiums are rising.

- Maintenance and reserve funding needs continue to grow.

These are fixed and rising costs — meaning the only flexible variable in the equation is the sale price.

To attract buyers in the current market, sellers must price realistically and competitively. Emotion, past sale comparisons, and what a unit was “worth” two years ago cannot override today’s financial reality.

In Short

The condo market isn’t struggling due to lack of interest — it’s struggling because affordability has shifted. Buyers aren’t willing to overpay when renting offers more flexibility at a lower monthly cost. Sellers who adapt their pricing to today’s financial environment will be the ones who succeed.

As always, I appreciate our relationship and I stand by to offer any information/ideas/perspectives to you, your friends and your family as needed.